#AAPL (Apple Inc.). Exchange rate and online charts

Currency converter

21 Mar 2025 21:59

(-6.15%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

Apple Inc. is the American IT-giant and the most expensive company in the world. Its capitalization exceeds $450 billion and the brand value according to different estimates reaches $98 to $185 billion. The company was established in early 70’s in California by Steve Jobs and Steve Wozniak, and first registered on April 1, 1976. The IPO was launched on December 12, 1980. In total, 4.6 bln securities were sold at the initial cost of $3.6. Until 2004 the share price did not go over $40. However, after the company refocused on the mobile devices, the share price has multiplied by 6 times. Moreover, after the release of the iPad, the shares of Apple Inc. surged to the mark of $700. Now the asset turnover is about 900 billion and the unit price fluctuates around $500.

Apple Inc. share price has been growing by approximately 16.1% for the last three years. The dividend yield equals 2.23% and EPS 42% a year. Cost of securities is directly bound to the quarterly reports and new devices releases. The main income of Apple Inc. is constituted by expanding iPhone sales, which comprise about 67% of gross income. Consequently, the company’s share value is much influenced by the success of new Apple smartphones.

See Also

- Bulls had the upper hand for two weeks, but it's time for a pause

Author: Samir Klishi

12:02 2025-03-21 UTC+2

2200

Today, following the release of data showing a February slowdown in the national Consumer Price Index (CPI), the Japanese yen continues to trade with a negative tone, creating uncertainty in the market.Author: Irina Yanina

12:07 2025-03-21 UTC+2

2200

The GBP/USD pair declined by 25 basis points on Friday heading into the U.S. session.Author: Chin Zhao

19:42 2025-03-21 UTC+2

2110

- Technical analysis

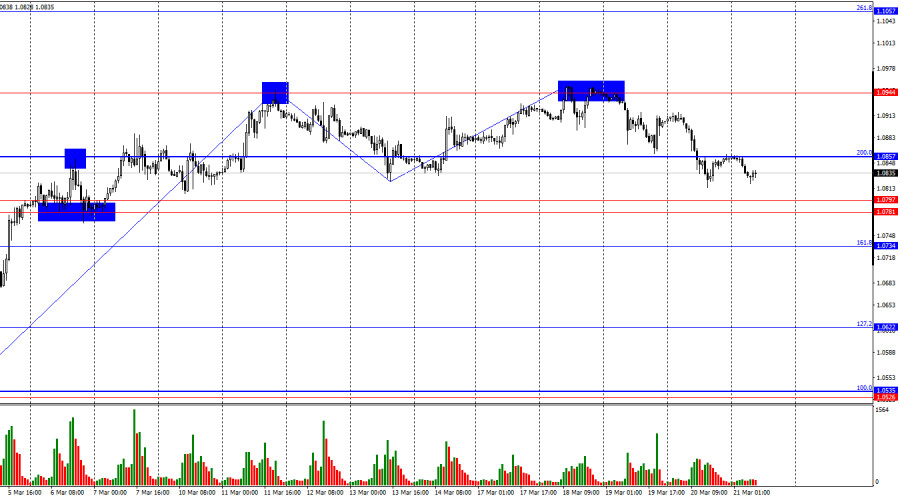

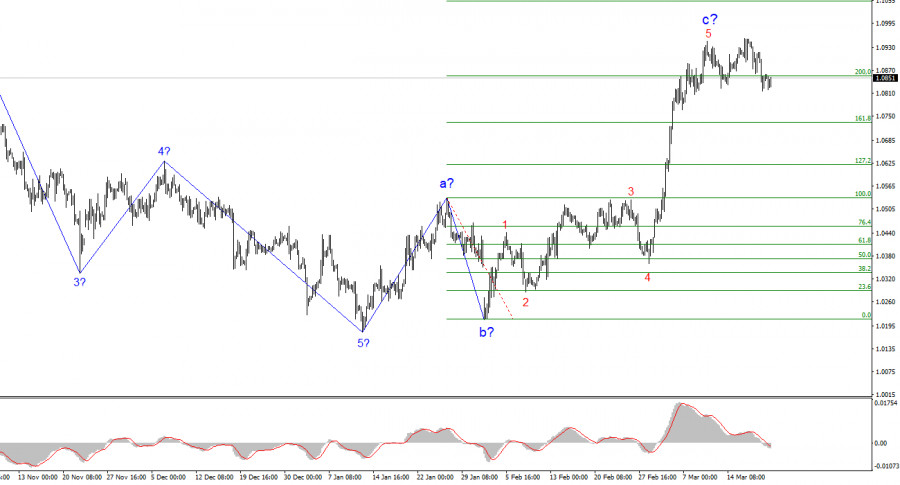

Trading Signals for EUR/USD for March 21-24, 2025: buy above 1.0810 (+1/8Murray - rebound)

Our medium-term forecast remains bearish. So, any technical rebound will be seen as a signal to sell with a medium-term target at about 1.0361, the level where the instrument left a gap.Author: Dimitrios Zappas

14:22 2025-03-21 UTC+2

2095

US stock market in limbo despite positive economic dataAuthor: Andreeva Natalya

15:48 2025-03-21 UTC+2

2080

The outcomes of the Bank of England and FOMC meetings contradicted each otherAuthor: Samir Klishi

11:52 2025-03-21 UTC+2

1945

- Technical analysis

Trading Signals for GOLD (XAU/USD) for March 21-24, 2025: buy above $3,026 (7/8 Murray - 61.8%)

The Eagle indicator is reaching oversold levels. So, we believe that gold could resume its bullish cycle in the coming days. For this, we should expect consolidation above the psychological level of $3,000.Author: Dimitrios Zappas

14:04 2025-03-21 UTC+2

1945

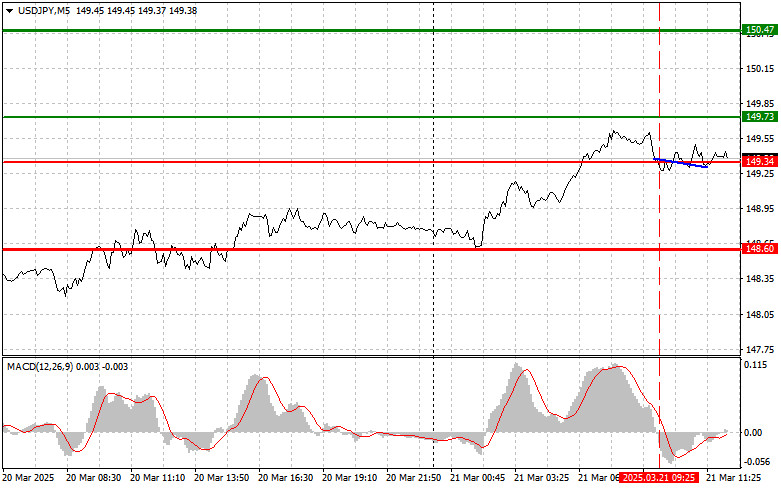

USDJPY: Simple Trading Tips for Beginner Traders on March 21st (U.S. Session)Author: Jakub Novak

19:30 2025-03-21 UTC+2

1915

The EUR/USD pair saw no change on Friday. There was no news background in the direct sense of the word today, so the market had nothing to respond to, and trader activity remained minimal.Author: Chin Zhao

19:39 2025-03-21 UTC+2

1915

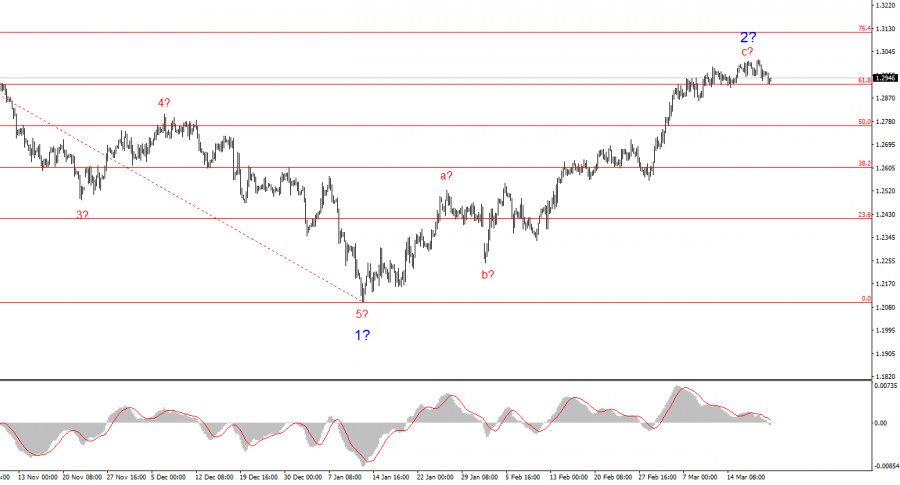

- Bulls had the upper hand for two weeks, but it's time for a pause

Author: Samir Klishi

12:02 2025-03-21 UTC+2

2200

- Today, following the release of data showing a February slowdown in the national Consumer Price Index (CPI), the Japanese yen continues to trade with a negative tone, creating uncertainty in the market.

Author: Irina Yanina

12:07 2025-03-21 UTC+2

2200

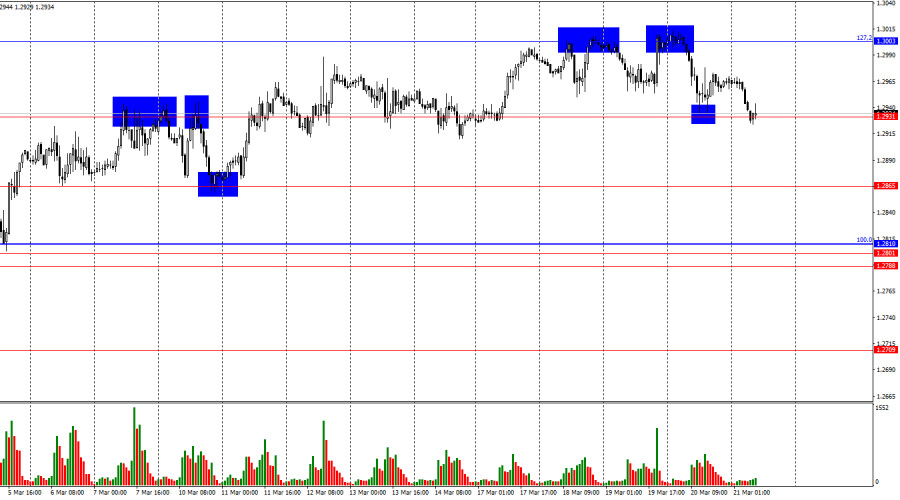

- The GBP/USD pair declined by 25 basis points on Friday heading into the U.S. session.

Author: Chin Zhao

19:42 2025-03-21 UTC+2

2110

- Technical analysis

Trading Signals for EUR/USD for March 21-24, 2025: buy above 1.0810 (+1/8Murray - rebound)

Our medium-term forecast remains bearish. So, any technical rebound will be seen as a signal to sell with a medium-term target at about 1.0361, the level where the instrument left a gap.Author: Dimitrios Zappas

14:22 2025-03-21 UTC+2

2095

- US stock market in limbo despite positive economic data

Author: Andreeva Natalya

15:48 2025-03-21 UTC+2

2080

- The outcomes of the Bank of England and FOMC meetings contradicted each other

Author: Samir Klishi

11:52 2025-03-21 UTC+2

1945

- Technical analysis

Trading Signals for GOLD (XAU/USD) for March 21-24, 2025: buy above $3,026 (7/8 Murray - 61.8%)

The Eagle indicator is reaching oversold levels. So, we believe that gold could resume its bullish cycle in the coming days. For this, we should expect consolidation above the psychological level of $3,000.Author: Dimitrios Zappas

14:04 2025-03-21 UTC+2

1945

- USDJPY: Simple Trading Tips for Beginner Traders on March 21st (U.S. Session)

Author: Jakub Novak

19:30 2025-03-21 UTC+2

1915

- The EUR/USD pair saw no change on Friday. There was no news background in the direct sense of the word today, so the market had nothing to respond to, and trader activity remained minimal.

Author: Chin Zhao

19:39 2025-03-21 UTC+2

1915