Oil prices are rapidly falling this morning. The fall has already become quite tangible, but the most dangerous thing is that there is nothing to stop it yet. The catalyst continues to be the banking sector of the United States, which could not withstand the onslaught of news about the tightening of the country's monetary policy.

Market participants are seriously concerned about the news of mass bankruptcies of American financial institutions. We have learned about several cases of large players having to leave the market. This has obviously alerted investors, who try to secure their assets and leave such an unpredictable sector like the commodity one. Especially because recently there were already enough reasons for panic.

Thus, even the Federal Reserve's tight monetary policy, which has not yet been adopted for implementation, is already leading to serious negative consequences. Crude oil lost about 1% this morning alone.

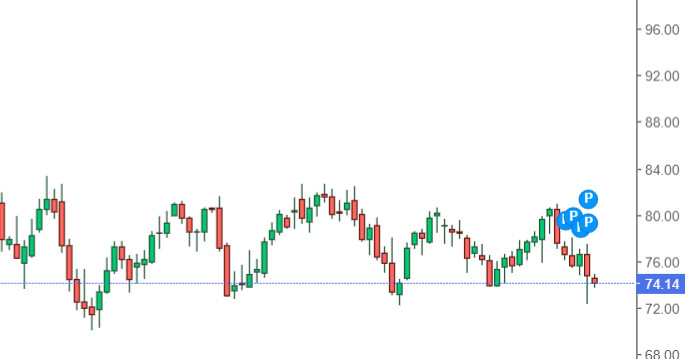

Brent crude oil for May fell this morning on the London ICE Futures Exchange. The fall has already amounted to 1.05%, which has forced the price to fall below the strategically important mark of $80 per barrel. It is now consolidating around $79.92 a barrel. The danger is that this decline is unlikely to stop in the near future, which means that we need to prepare for an even greater disappointment.

The West Texas Intermediate (WTI) for April delivery also fell significantly on the New York Mercantile Exchange this morning. The morning dip was recorded around 11.1%, which moved them to $73.97 a barrel. If this trend continues, the mark risks falling below $70 a barrel.

The risk is not very justified. And even more so when it comes to crude oil. Therefore, market participants prefer to limit their exposure in this sector. The main wave of negativity occurred precisely against the backdrop of growing problems in the banking system of the United States of America. Several financial institutions have already announced the initiation of bankruptcy proceedings. And most likely, they will not be the only ones, since the Fed will continue to tighten monetary policy, and the consequences are already felt in advance.

The world's stock markets were the first to shake. Yesterday, European stock exchanges immediately fell by 3%. The Asian market followed suit. So far it has reached the level of 2%.

Following the stock market, the negative trend was also transferred to the commodity sector. Prices for copper and oil declined significantly. At the same time, protective assets came to the fore, with the help of which investors traditionally try to save their savings. These traditionally include gold, for which positive times are coming. In addition, growth was also noted in the cryptocurrency sector. In particular, Bitcoin is also trying to increase its value while other sites are experiencing a negative.

The increased level of volatility in world markets provoked a crisis of US financial institutions. Many of America's major banks have already launched closing procedures. These are Silvergate, Silicon Valley Bank and Signature Bank. The Fed's aggressive lifting of interest rates is cited as the main reason. Just waiting for this event has already led to a depreciation of the assets included in most financial institutions. So what will happen when the central bank begins to fully implement its plans?

Nevertheless, US authorities are already prepared to look for a way out of this situation. They have already announced special measures to support the banking sector, the main task of which will be related to the prevention of further default.

Crude oil staunchly tried to fight the impending catastrophe, but still gave up before the onslaught of obvious and strong factors to decline. Moreover, analysts warn that the level of volatility in the near future will be extremely high in the markets, so we need to prepare for even more disastrous consequences. In the short term, the US inflation indicator will have an impact. And most likely, you should not expect any positives from its change.

Moreover, the Fed will start to determine its next steps using the new level of inflation. Therefore, after the release of a new batch of macro data, it will become clear how much the Fed will tighten its policy.

In addition, the next OPEC report will also be presented to the general public today. It is also important for the oil market, as it contains the main forecasts regarding the movement of prices and demand for oil. And just the demand and the corresponding level of supply will play a decisive role for investors. Perhaps the reports will be so good that the oil market will be able to get out of the crisis.

Nevertheless, focusing on experts' forecasts, it is worth noting that the Brent oil brand now has more than real chances to reduce its position to the level of 70-72 dollars a barrel. Such a situation took place at the end of last year, but then they managed to cope with the situation and break the trend. Now it is impossible to say whether oil will be able to find the benchmark for growth.

Some analysts are still confident that such a significant drop will not happen. The most expected scenario is a retreat to the level of $78-80 a barrel. This is exactly the scenario to rely on in the near future. In this case, experts are guided by the fact that the collapse of the US banking system is not abrupt, but gradual. Oil will have time to adapt to new conditions of existence in between portions of negativity.