The pound is rising and UK bonds have risen amid expectations that part of Prime Minister Liz Truss' unsecured tax cut package will be cancelled. Stocks rose as investors prepare for a number of key company earnings reports this week.

Chancellor Jeremy Hunt is expected to make a statement at 11am London time on measures to support financial sustainability. It's the start of a week that could get particularly hot for British assets as Truss fights to save her premiership after the Bank of England ended its emergency bond-buying program on Friday and rebellious supporters conspired to overthrow her.

US stock contracts rose as investors focused on earnings, including from Bank of America Corp., Goldman Sachs Group Inc. and Tesla Inc.

Chinese stocks listed in the United States rose in the premarket, while Chinese stocks stopped declining, as President Xi Jinping confirmed that economic development is the main priority of the party, and in his speech offered support to the technology sector, but disappointed investors hoping for signs of a departure from the zero level of Covid. Shares of utilities and insurance companies showed growth in Europe.

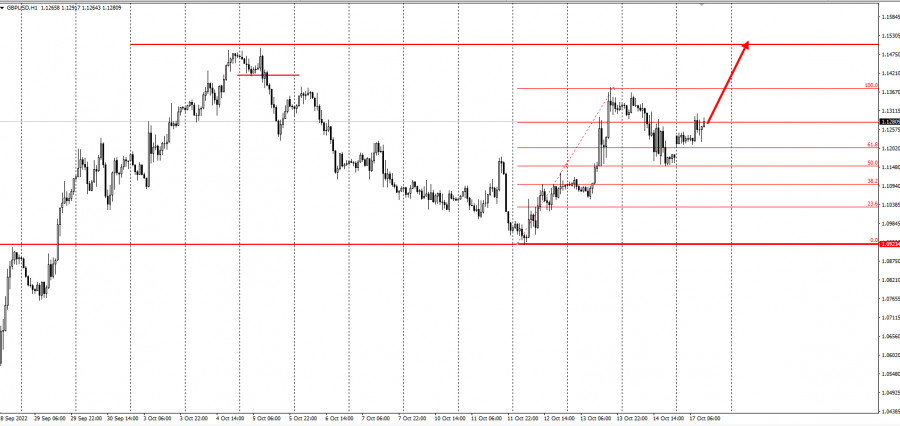

The yield on 10-year bonds fell by 28 basis points to 4.05%, and the pound rose 0.8% to $1.1264. Treasury bond yields and the dollar declined against their Group of 10 counterparts, providing a little respite to exhausted currency markets.

"I think we are entering a period where the credibility of the UK is constantly being questioned, and British assets remain incredibly volatile for a significant period of time," Benjamin Jones, director of macroeconomic research at Invesco, said on Bloomberg Television. "Monitoring the gold market will be absolutely key to understanding whether the market really considers Hunt more stable and whether he will be able to implement this policy."

Hunt will also address the House of Commons at 15:30 London time, and on Monday evening Truss will hold a reception in honor of the Cabinet at 10 Downing Street. Although the early rise in the pound indicates confidence in Hunt's alternative approach, economists still warn that there is a hole in the budget worth 28 to 50 billion pounds that needs to be filled, depending on the pace of debt reduction.

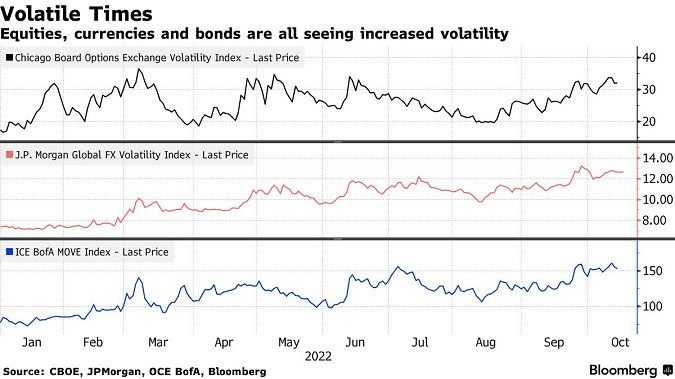

Meanwhile, the forecast of consumer prices in the United States continues to fuel bets that the Federal Reserve may go for a sharp increase in rates at the next two meetings, which will generally affect the prospects for global economic growth and markets.

Fed officials in their recent comments suggested that they are ready to raise rates higher than previously planned. Kansas City Fed President Esther George said the final rate may need to be raised to cool prices. Mary Daly of the San Francisco Fed said she was "very supportive" of an increase to restrictive levels, and 4.5% to 5% "is the most likely outcome."

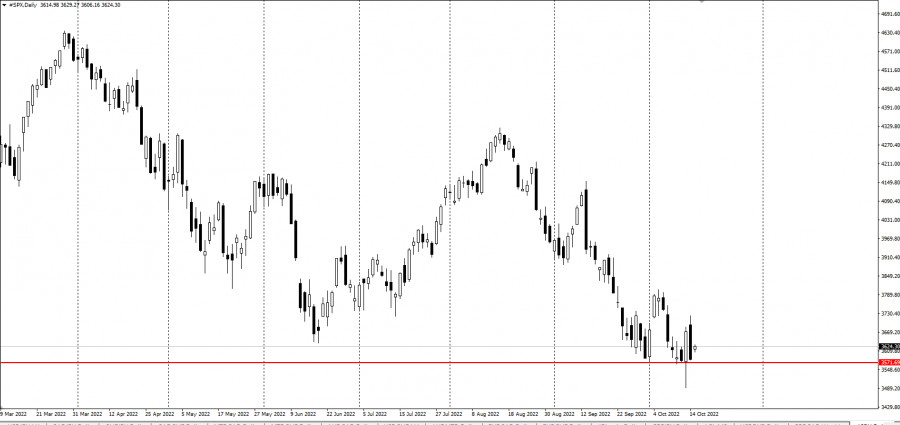

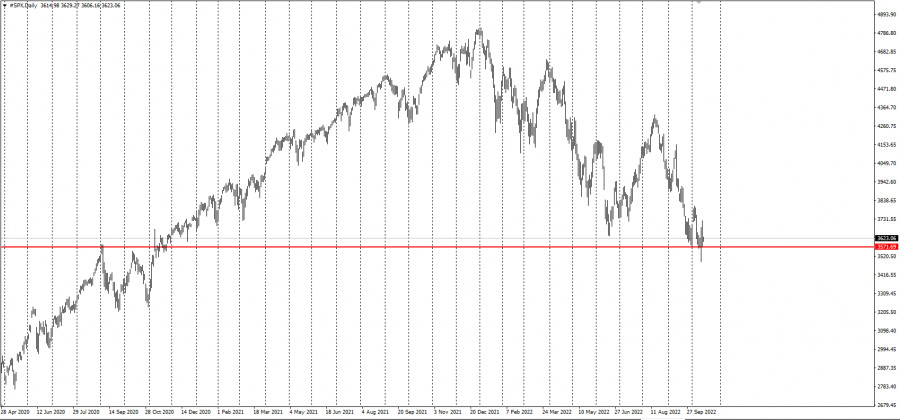

Morgan Stanley Strategist Michael J. Wilson, a longtime stock bear, said U.S. stocks are ripe for a short-term rally in the absence of earnings capitulation or an official recession. A 25% drop in the S&P 500 this year has led to testing of a "serious level of support," which could lead to a technical recovery, he wrote in a note on Monday.

In other sectors of the markets, oil fluctuated after a week-long decline, as concerns about slowing economic growth continue to put pressure on demand prospects. Gold has risen in price amid the weakness of the US dollar and growing fears of a global economic downturn, raising the status of the precious metal as a haven.

Key events this week:

- Speech by ECB Vice President Luis de Guindos, Monday

- Retail sales in China, industrial production, GDP, unemployed surveyed, Tuesday

- US industrial production, NAHB Housing Market Index, Tuesday

- Speech by Fed Chairman Neel Kashkari on Tuesday

- Eurozone Consumer Price Index, Wednesday

- UK Consumer Price Index, PPI, retail price index, Wednesday

- Applications for mortgage loans under the MBA program in the USA, building permits, housing commissioning; The Fed's Beige Book, Wednesday

- Neel Kashkari of the Fed, Charles Evans, James Bullard will speak on Wednesday

- Secondary home sales in the US, initial applications for unemployment benefits, Conference Board leading index, Thursday