The GBP/USD currency pair rose confidently on Wednesday, despite the UK's morning report performing worse than similar reports from Europe, providing the market with even fewer reasons to buy compared to the euro. However, we had cautioned that the market was prepared to buy the pair regardless, as a correction on the daily timeframe has been ongoing for nearly a month. Trump's actions had caused the GBP/USD pair to decline on Monday, which required a complete reformation of the correction. The UK Services PMI for January came in at 50.8, lower than the forecast of 51.2. So, what was the reason behind the pound's rise of 60 to 70 pips during the first half of the day, especially considering there were no other significant events?

The Bank of England meeting is set to take place today. The pound sterling continues to strengthen, although it is expected that today there will be an announcement regarding the easing of monetary policy. Additionally, we believe that Andrew Bailey will clarify to the market that the central bank is prepared for further easing, and the four stages of lowering the key rate may continue beyond 2025. Why is this happening? The UK economy continues to struggle and shows little sign of growth. There are numerous reasons for these challenges. It's important to note that the pound sterling has been declining since 2008, and the British economy has encountered problems since 2016.

If the BoE is significantly more dovish than the Federal Reserve, why is the pound rising, and what are its prospects? The pound is rising purely for technical reasons. The market's behavior yesterday, particularly in the first half of the day, clearly illustrates this. Until we see a proportional correction on the daily timeframe that matches the previous decline, the pound will continue to rise in its typical manner—without any reason for this. It's difficult to predict when this correction will end; it could last three months or even up to six months. However, it's quite strange to observe the pound increasing when the BoE is preparing for at least four rate cuts, whereas the Fed may not even lower its rate twice. For this reason, we maintain the view that the global downtrend remains intact. We anticipate a correction followed by a significant decline of the British pound.

Donald Trump could potentially influence this forecast. It wouldn't be surprising if, over time, the U.S. The president attempts to pressure Jerome Powell to cut interest rates and weaken the dollar. Trump during his first term frequently stated that he does not need a "strong" dollar. Since the dollar has been strengthening for the past 16 years, it is unlikely that he will change his position now. The specific actions he might take in this regard are unpredictable. The Fed operates independently and is not directly subject to Trump or Congress, but there are various mechanisms of pressure that could be employed. At this time, however, there is no concrete information on this matter, so we see no reason to adjust our medium-term forecast.

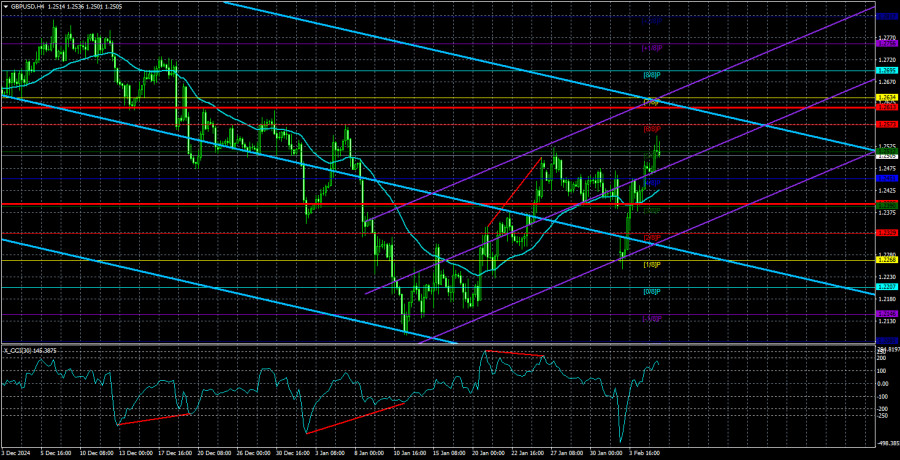

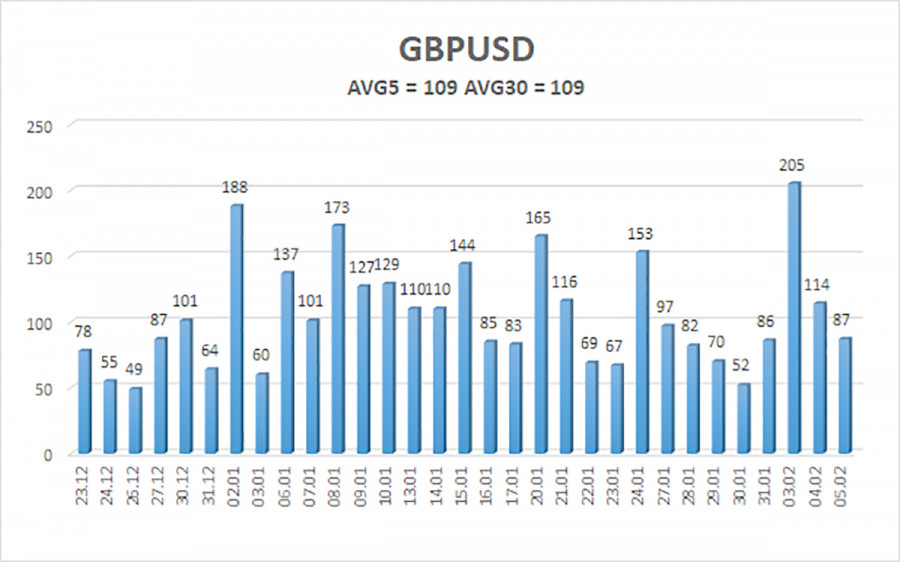

The average volatility of the GBP/USD pair over the last five trading days stands at 109 pips, which is considered "average" for the pound/dollar pair. Therefore, on Thursday, February 6, we expect movement within the range bounded by the levels of 1.2395 and 1.2613. The higher linear regression channel remains downward-sloping, signaling a bearish trend. The CCI indicator entered the oversold zone, warning of a new wave of upward correction.

Nearest Support Levels:

- S1 – 1.2451

- S2 – 1.2390

- S3 – 1.2329

Nearest Resistance Levels:

- R1 – 1.2512

- R2 – 1.2573

- R3 – 1.2634

Trading Recommendations:

The GBP/USD currency pair is currently in a medium-term downtrend. We do not recommend taking long positions, as we believe that the market has already priced in all potential growth factors for the British currency multiple times, and there are no new catalysts on the horizon.

For those trading based purely on technical setups, long positions may be considered if the price moves above the moving average line, with targets set at 1.2573 and 1.2613. Sell orders are more relevant at this time, with initial targets at 1.2307 and 1.2268. But the price must confirm the upward correction on the daily time frame.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.